LUMAX Industries | Initiating Coverage

August 28, 2018

LUMAX Industries

BUY

CMP

`2055

LUMAX Industries limited, (LIL) a flagship company of D.K. Jain Group with the presence in

Target Price

`2550

Automotive Lighting Industry. The Company has over 3 decades of strong partnership

Investment Period

12 Months

with Stanley Electric Co. ltd. LIL is the market leader & supplies to majority of OEM’s

including MSIL, HMSI, Hero Moto Corp, M&M, TATA Motors, Honda Cars and others. The

Company has nine manufacturing plants in India, strategically located near manufacturing

Stock Info

location of OEMs. LIL also served Hundyai through its associate company SL Lumax

Sector

Auto-Ancillary

Market Cap (` cr)

2,086

(21.28% stake of LIL) in the automotive Lighting space.

Beta

1.3

Strong relationship with MSIL provide better revenue visibility: LIL’s 68% revenue comes

52 Week High / Low

2585/1170

from PV and MSIL’s various models of Notchback/Hatchback/SUV segments contribute

Avg. Daily Volume

748

Face Value (`)

10

roughly 32% (in FY18) of total lightening revenue. We expect domestic PV sales to grow

BSE Sensex

38,694

at CAGR 12.87% over FY16-26.

Nifty

11,691

Improving product mix and margin: Owing to changing industry dynamic vis-à-vis

Reuters Code

LUMA.BO

Bloomberg Code

LUMX IN

increasing acceptability of LED lamps in upper variant of Mid, Compact and SPV segments

of PV Moreover increasing safety norm in 2W segment which require AHO features to

install on all new vehicle also helps to increase the adoption of LED lamps provide better

Shareholding Pattern (%)

revenue visibility to LIL going forward. Realization in LED lamp is higher as compared to

Promoters

74.9

non-LED lamp due to addition of new technology in lightening system. Share of LED lamp

MF / Banks / Indian Fls

0.6

has improved from 8% in FY17 to 35% in Q1FY19 management believe this ratio to

FII / NRIs / OCBs

0.8

improve further going forward

Indian Public / Others

23.7

Increasing plant capacity: LIL has strategically located its plant near to major OEMs

which enables LIL to provide faster supply of lighting equipment to its Recently LIL has

commissioned 3,00,000 car sets per year at Sanand, Gujarat from where it is serving to

Abs.(%)

3m

1yr

3yr

MSIL’s at present and way forward to TML and HMSI also. Management also guided for

Sensex

10.0

21.9

50.0

addition capacity and other routine maintenance capex of INR80cr. in FY19 in some of the

LUMAXIND

(12.6)

56.5

374.8

parts

Outlook & Valuation: Strong relationship with majority of Auto OEM, increasing sales of

PV, 2W and CV and Improving revenue mix from Halogen lamp to LED lamp leads to

better revenue and realization going ahead. Moreover LIL is also looking to localizes the

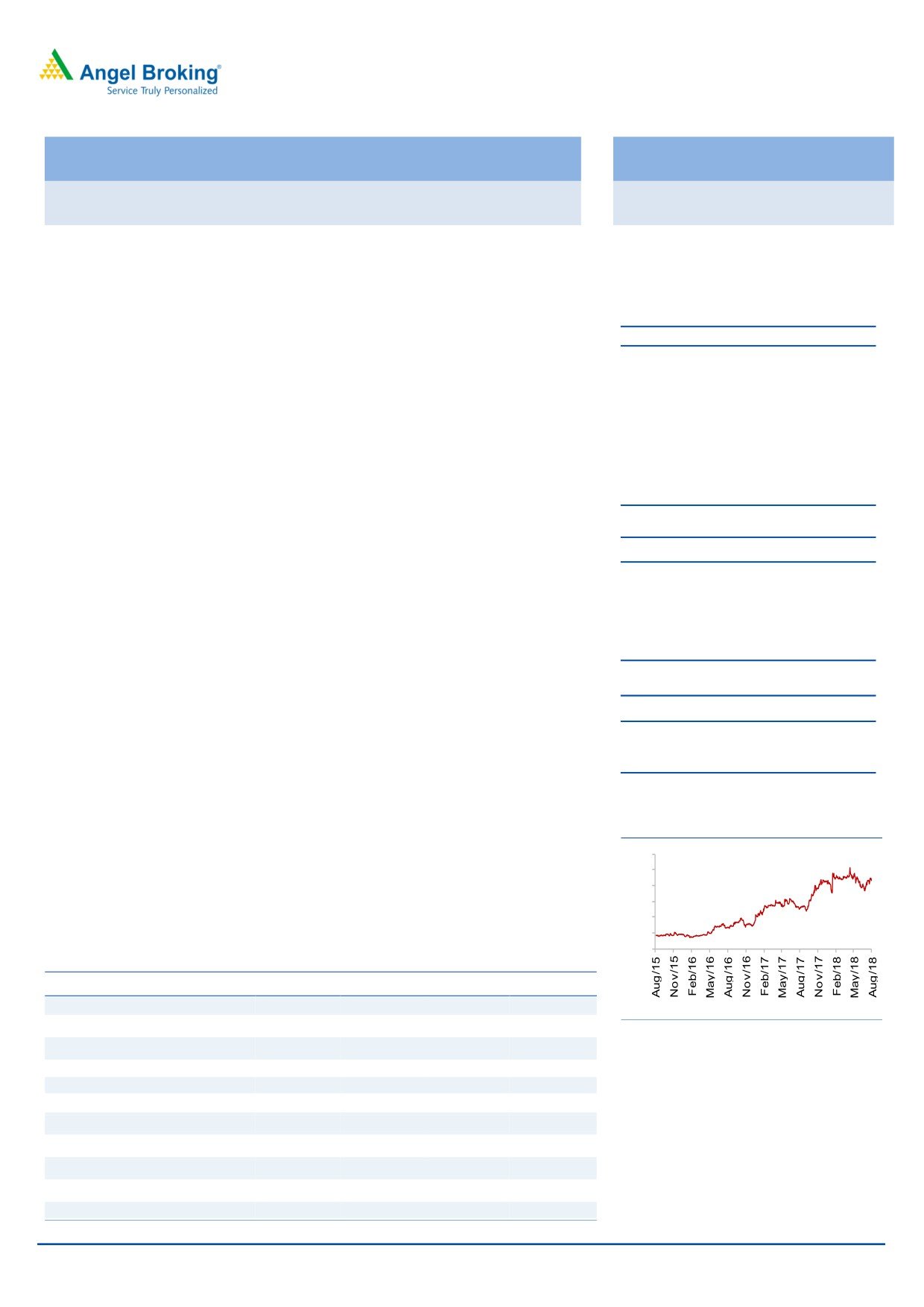

3 Years Performance charts

manufacturing of LED lamp which is currently imported, management believe this will

3000

2500

help LIL to improve margin up to 10% by FY20. We like to initiate coverage on the LIL

2000

with BUY recommendation. At the CMP of INR 2055 LIL is available at 17X of FY20E EPS

1500

INR 122. On the basis of above arguments we like to assign a multiple of 21X on FY20 EPS

1000

500

to arrive at price target of INR2550 (upside 24%).

0

Exhibit 1: Key Financials

Y/E March (` cr)

FY16

FY17

FY18

FY19E

FY20E

Net Sales

1,255

1,271

1,650

1,980

2,336

% chg

10

1

30

20

18

Source: Company, Angel Research

Net Profit

52

54

71

92

114

% chg

2,160

4

31

29

23

EBITDA (%)

7.1%

7.9%

8.2%

8.6%

8.9%

EPS (Rs)

39

58

76

98

122

Kripashankar Maurya

P/E (x)

52

35

27

21

17

022 39357600, Extn: 6004

P/BV (x)

7.2

6.2

5.3

4.5

3.8

RoE (%)

13.7

17.6

19.7

21.6

22.6

RoCE (%)

13.9

15.2

18.7

21.2

22.9

EV/EBITDA

22.7

19.7

14.9

11.7

9.4

Source: Company, Angel Research; Note: CMP as of Aug 27, 2018

August 28, 2018

1

LUMAX Industries | Initiating Coverage

Company background

LUMAX Industries limited, (LIL) a flagship company of D.K. Jain Group with the

presence in Automotive Lighting Industry. The Company has over 3 decades of strong

partnership with Stanley Electric Co. ltd. LIL is the market leader & supplies to majority

of OEM’s including MSIL, HMSI, Hero Moto Corp, M&M, TATA Motors, Honda Cars

and others. The Company has nine manufacturing plants in India, strategically located

near manufacturing location of OEMs. LIL also served Hunyadi through its associate

company SL Lumax (21.28% stake of LIL) in the automotive Lighting space.

Key Management Personnel

Mr. D.K. Jain, he is the Chairman Emeritus & Chief Mentor of Lumax Industries. With

over 50 years of experience in auto component sector. He is an MBA from Delhi

University and a Harvard Business School alumnus. He has held various industry

positions like the president of ACMA, president of Suppliers Association- Toyota

Kirloskar Motors, chairman of Trade Affairs Committee ACMA, co-chairman of

Regional Committee on Membership of Northern Region-CII and Chairman, Regional

Committee-CSR, Northern region-CII.

Mr. Deepak Jain, He is the Chairman & Managing Director of Lumax Industries. With

over 21 years of experience in Automotive industry. He served at various Sr. position in

Lumax. He is the current Chairman of Northern region of ACMA and has held various

industry positions National Coordinator of Young Business Leader Forum of ACMA,

President of Supplier’s club, Honda Cars India Limited, Co-Chairman of Northern

Region of ACMA & Vice President of Toyota Kirloskar Supplier’s Association. He is also

Member of Young President Organisation and Entrepreneurs’’ Organisation., Mr. Jain

is a Business Graduate from the Illinois Institute of technology and in his early days he

has also undergone training in Stanley Co. USA and Stanley Electric Co. Japan.

Mr. Anmol Jain, He is Joint MD of Lumax industry and associated with Lumax since

2000 and has more than 17 years of experience. He is the alumnus of Michigan State

University, USA, where he did his Bachelors in Business administration with a dual

major in Finance and Supply Chain Management.

Mr. Vineet Sahni, He is Chief Executive Officer & Senior Executive Director at Lumax

Industries and he is elevated from Chief Executive Officer of Lighting Business. With

over 30 years of experience in Automotive industry. Mr. Sahni served as the Business

Head of Lighting Division of Minda Industries Ltd and President of Strategic Business -

Automotive Lighting of NK Minda Group. He also serves as the NK Minda's Group

Functional Head for Marketing & Design. A veteran in automotive industry, with over

30 years of varied leadership experience in the industry. He commenced his career

with Tata Motors in 1987 and has held various positions of increasing responsibility

over the years with Minda Group and Varroc Engineering. He is a B.E. Mechanical from

Delhi College of Engineering.

August 28, 2018

2

LUMAX Industries | Initiating Coverage

Industry outlook

India Automotive Lighting Market Overview:

India Automotive Lighting Market is expected to garner $3.1 billion by

2022,

registering a CAGR of 5.6% from 2016-2022. Lighting is a vital component in

automotive vehicles, playing an important role in automotive safety. The vehicle

consists of different lights to increase the visibility in darkness and bad weather

conditions along with the increase in conspicuity. The lighting system comprises

lighting and signaling devices, which are placed at different locations such as front,

rear, side, and interiors. Lighting provides illumination for the driver and helps other

vehicle drivers and pedestrians on the road to detect the vehicle’s position, direction

of movement, and size. It also enhances the aesthetic looks to both interior and

exterior parts of the vehicle.

Indian Automotive industry

The automobile industry in India is world’s fourth largest, with the country currently

being the world's 4th largest manufacturer of cars and 7th largest manufacturer of

commercial vehicles in

2017. Indian automotive industry (including component

manufacturing) is expected to reach INR 16.16-18.18 trillion (US$ 251.4-282.8 billion)

by 2026. Two-wheelers dominate the industry and made up 81 per cent share in the

domestic automobile sales in FY18. Overall, Domestic automobiles sales increased at

7.01 % CAGR between FY13-18 with 24.97 million vehicles getting sold in FY18. Indian

automobile industry has received Foreign Direct Investments (FDI) worth US$ 18.76

billion between April 2000 and March 2018.

The passenger vehicle sales in India crossed the 3.2 million units in FY18, and is further

expected increase to 10 million units by FY20. Auto sales in Q1 FY19 witnessed a year-

on-year growth rate of 18.1% across segments, driven by a 19.91 % growth in

passenger vehicle sales.

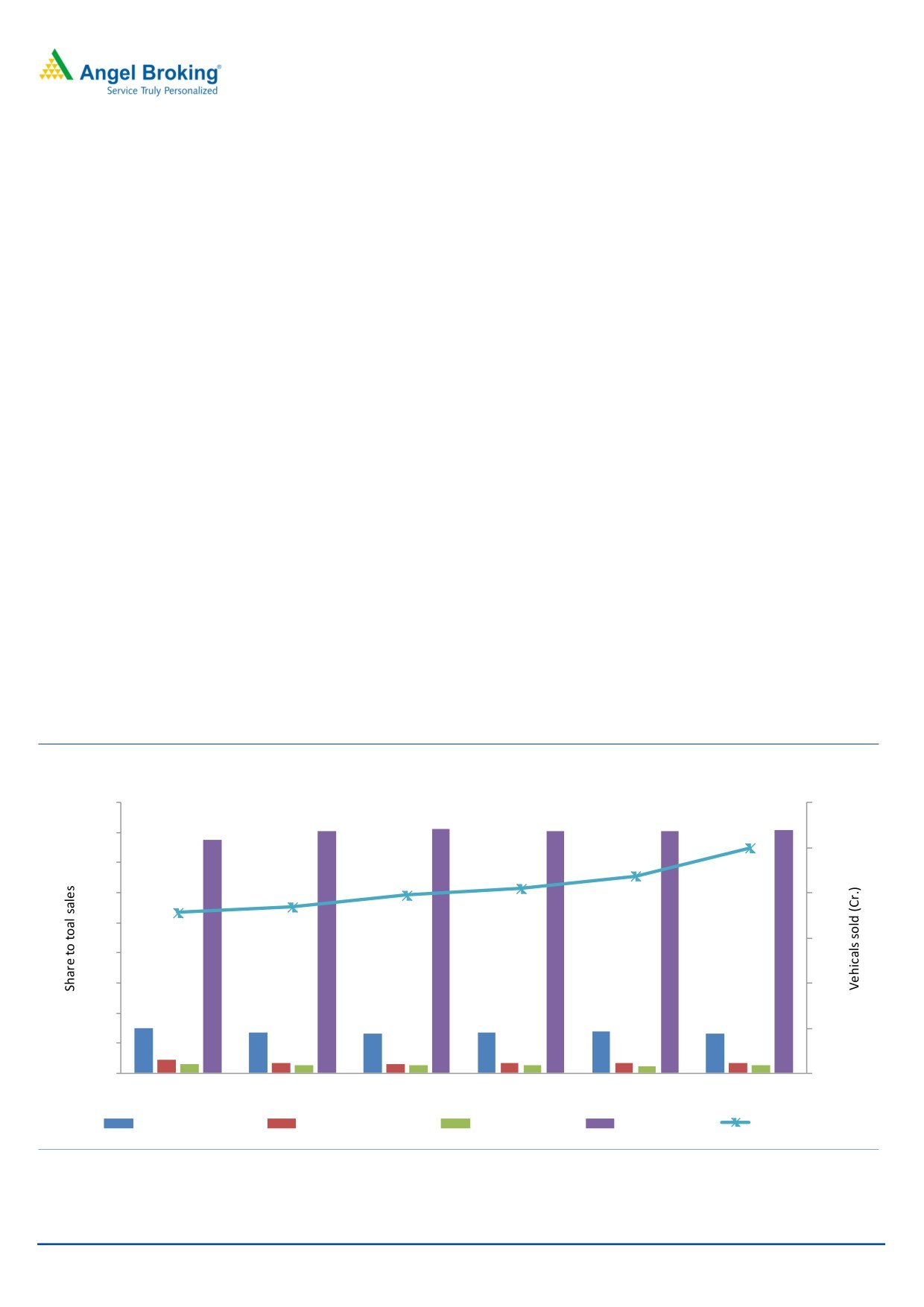

Exhibit 1: Indian Automotives sales trends

Indian Automotive sales trends

90%

3.0

80%

81%

80%

80%

81%

78%

80%

2.5

2.5

70%

2.2

60%

2.0

2.0

2.0

1.8

1.8

50%

1.5

40%

30%

1.0

20%

15%

14%

13%

14%

14%

13%

0.5

10%

4%3%

3%3%

3%3%

3%3%

3%

2%

3%

3%

0%

0.0

2012-13

2013-14

2014-15

2015-16

2016-17

2017-18

Passenger Vehicles

Commercial Vehicles

Three Wheelers

Two Wheelers

Grand Total

Source: SIAM, Angel Research

August 28, 2018

3

LUMAX Industries | Initiating Coverage

Investment Argument

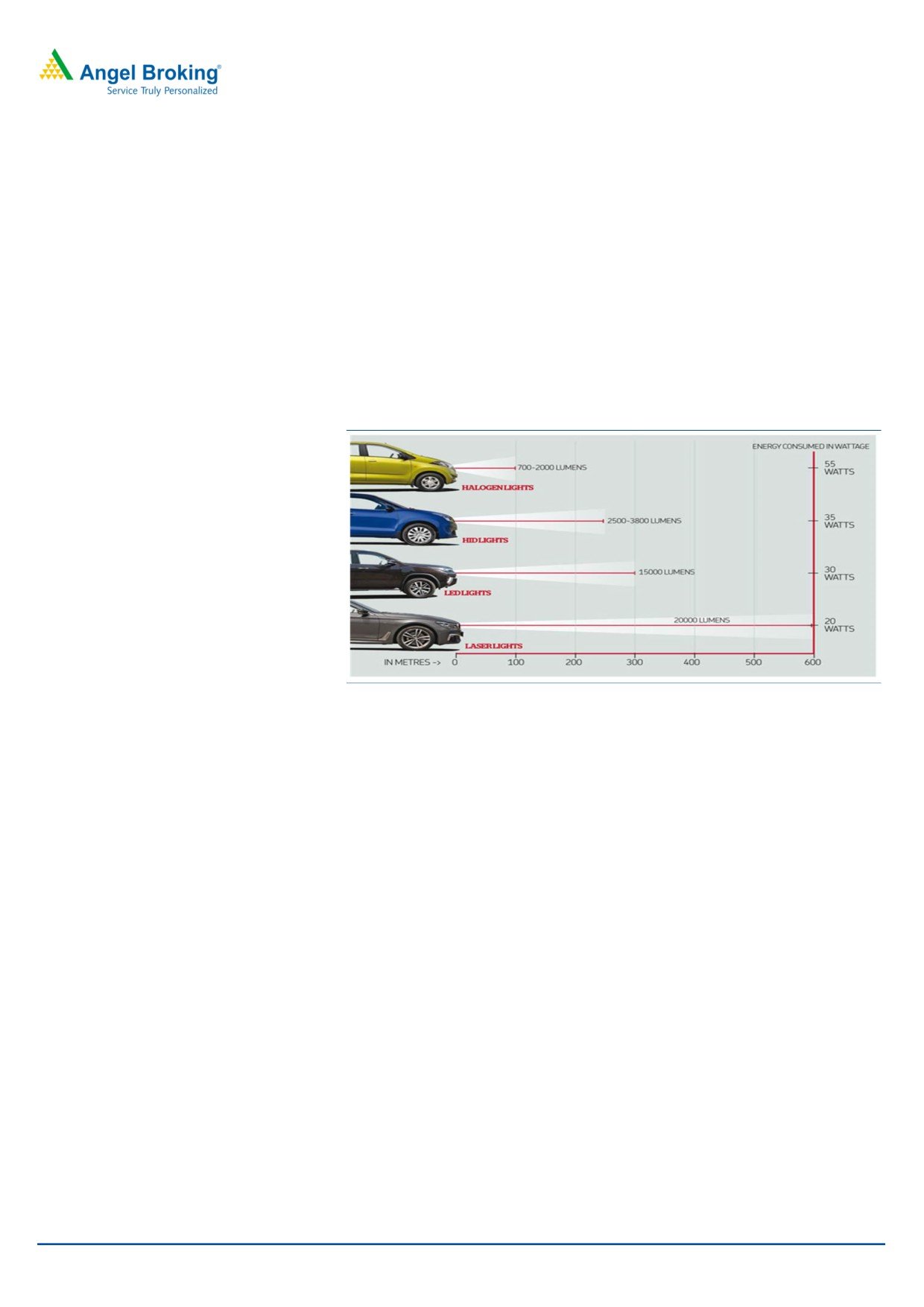

Changing automotive industry in favor of LED lightening

Shift from BS IV to VI will trigger various technological changes in automotive industry

in order to manufacturing of more energy efficient and environment friendly

automotive engines and parts. Lighting system is one the auto parts which also require

up-gradation in order to save energy, We believe technical transformation in auto

sector will increase the adoption of LED lamps going forward. Moreover as compare to

LED lamp which cost roughly 3X to 8X of Halogen lamps, but in terms of energy

consumption it saves around 80-90% energy as against Halogen lamps. Apart from

energy efficiency LED lamps has another advantages such as ample illumination,

design flexibility and product durability. We believe LIL is in sweet spot to tap these

opportunity going forward.

Exhibit 2: Types of lightning technology

Source: Autocar India, Angel Research

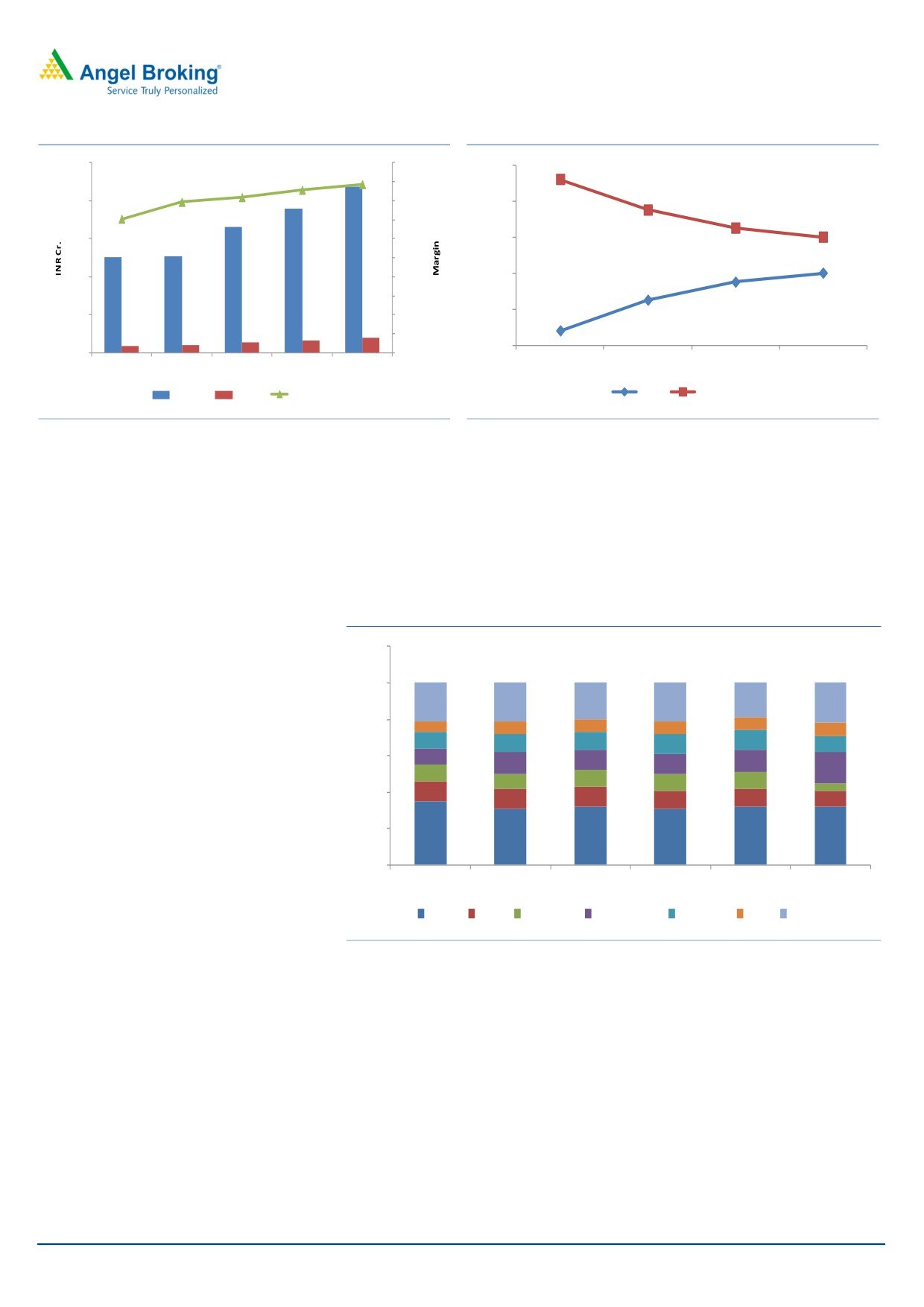

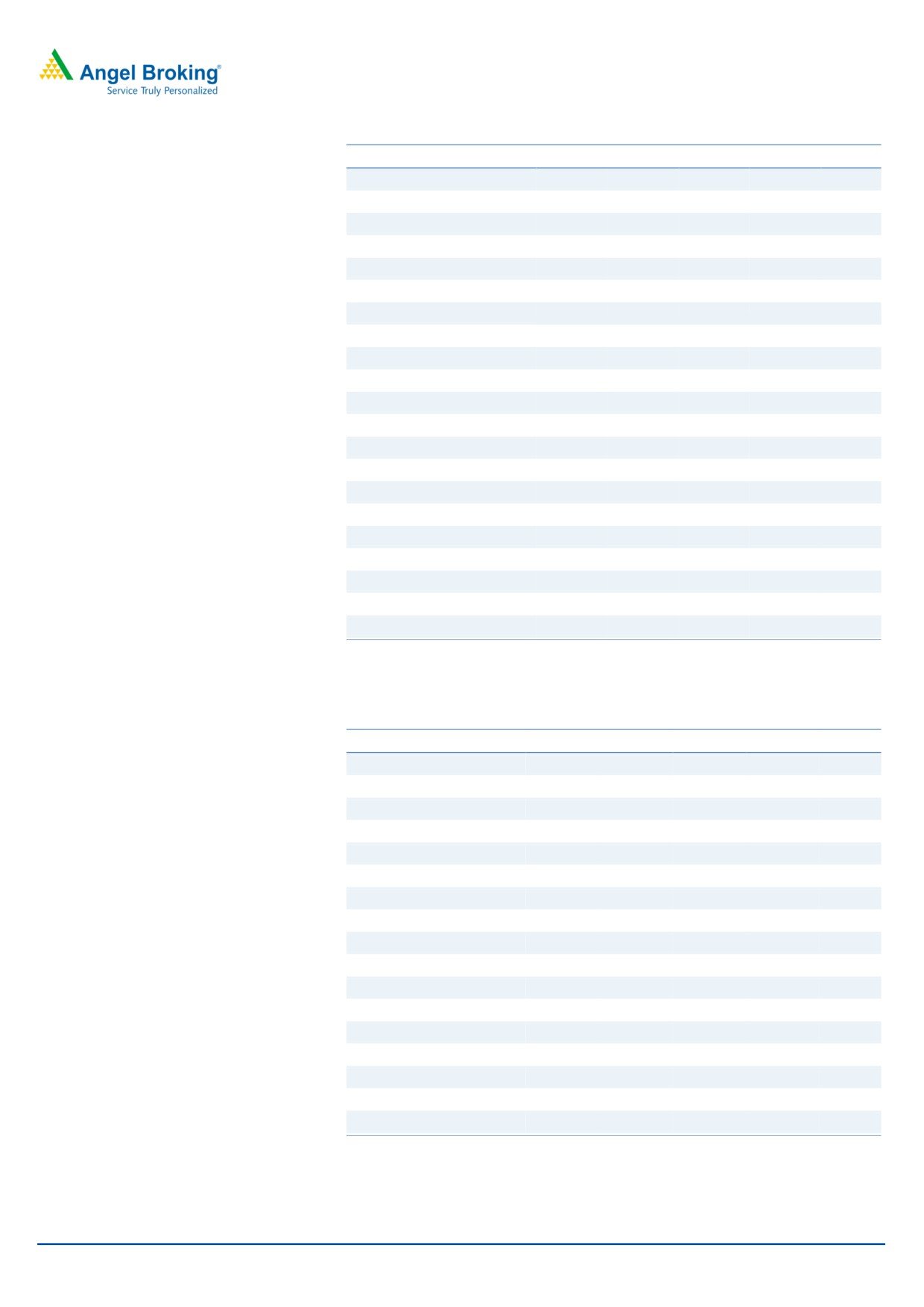

Improving product mix and margin

Owing to changing industry dynamic vis-à-vis increasing acceptability of LED lamps in

upper variant of Mid, Compact and SPV segments of PV Moreover increasing safety

norm in 2W segment which require AHO features to install on all new vehicle also

helps to increase the adoption of LED lamps provide better revenue visibility to LIL

going forward. Realization in LED lamp is higher as compared to non-LED lamp due to

addition of new technology in lightening system. Share of LED lamp has improved

from 8% in FY17 to 35% in Q1FY19 management believe this ratio to improve further

going forward.

August 28, 2018

4

LUMAX Industries | Initiating Coverage

Exhibit 3: Revenue & Margin mix

Exhibit 4: Shift in lightning mix

2500

10.00%

100%

Revenue and Margin trend

9.00%

92%

8.87%

8.57%

2000

8.19%

8.00%

80%

7.94%

75%

7.05%

7.00%

65%

1500

6.00%

60%

60%

5.00%

40%

40%

1000

4.00%

35%

3.00%

25%

20%

500

2.00%

1.00%

8%

0%

0

0.00%

FY17

FY18

Q1FY19

FY20E

FY16

FY17

FY18

FY19E

FY20E

Net Sales

EBITDA

EBIDTA Margin

LED

Non- Led

Source: Company, Angel Research

Source: Company, Angel Research

Strong relationship with MSIL provide better revenue visibility

LIL’s

68% revenue comes from PV and MSIL’s various models of

Notchback/Hatchback/SUV segments contribute roughly

32% (in FY18) of total

lightening revenue. We expect domestic PV sales to grow at CAGR 12.87% over FY16-

26.

Exhibit 5: Customer sales mix*

120%

100%

21%

21%

20%

21%

19%

22%

80%

6%

7%

7%

7%

7%

7%

9%

10%

10%

11%

11%

9%

60%

9%

12%

11%

11%

12%

17%

9%

8%

9%

9%

9%

4%

40%

11%

11%

11%

10%

10%

9%

20%

35%

31%

32%

31%

32%

32%

0%

FY17

Q1FY18

Q2FY18

Q3FY18

Q4FY18

Q1FY19

Maruti

M&M Honda Cars Honda Motors Hero Moto TATA Others

Source: Company, Angel Research

Note: *Exclude mould sales

Technical know-how with Stanley

LIL through its JV with Stanley Electric co., Ltd. a Japan based LED light manufacturer

(own 37.5% of LIL) gives access to the latest technologies of lightning technique which

in turn enhances LIL capabilities and reach. Moreover LIL two have in-house R&D

center and one design center at Taiwan which helps to design and provide fast

lighting solution to its customers.

Increasing plant capacity

LIL has strategically located its plant near to major OEMs which enables LIL to provide

faster supply of lighting equipment to its Recently LIL has commissioned 3,00,000 car

sets per year at Sanand, Gujarat from where it is serving to MSIL’s at present and way

August 28, 2018

5

LUMAX Industries | Initiating Coverage

forward to TML and HMSI also. Management also guided for addition capacity and

other routine maintenance capex of INR80cr. in FY19 in some of the parts.

Strong relationship with Hyundai

SL Lumax an associate company in which LIL hold 21.28% with SL Corporation, korea

based automotive player. SL lumax supply lightening solution and other automotive

component like Chassis, Trim& Mirror, shift lever and Parking brakes to OEM’s.

Hyundai is key customer for SL lumax.

Outlook and Valuation

Strong relationship with majority of Auto OEM, increasing sales of PV, 2W and CV and

Improving revenue mix from Halogen lamp to LED lamp leads to better revenue and

realization going ahead. Moreover LIL is also looking to localizes the manufacturing of

LED lamp which is currently imported, management believe this will help LIL to

improve margin up to 10% by FY20. We like to initiate coverage on the LIL with BUY

recommendation. At the CMP of INR 2055 LIL is available at 17X of FY20E EPS INR 122.

On the basis of above arguments we like to assign a multiple of 21X on FY20 EPS to

arrive at price target of INR2550 (upside 24%).

Risk and Concern

Downside risk to target revenue and net income is slower than expected adoption of

LED lamp by OEM’s and higher content of import raw material respectively. Upside risk

to target revenue is faster growth in PV and 2W segments.

Peer comparison

Sales (` cr.)

OPM %

PAT (` Cr.)

ROE (%)

PE(X)

Companies CMP `

FY18

FY19E FY20E

FY18

FY19E FY20E FY18 FY19E FY20E FY18 FY19E FY20E FY18 FY19E FY20E

Lumax Ind

2055

1,650

1,980

2,336

8

9

9

71

92

114

20

22

23

27

21

17

Fiem Ind

756

1274

1441

1689

12

12

12

53

68

89

12

14

17

20

15

12

Minda Ind

418

4470

5571

6458

14

12

13

302

352

425

21.7

22.4

22.2

36

31

25

Source: Bloomberg, Angel Research

August 28, 2018

6

LUMAX Industries | Initiating Coverage

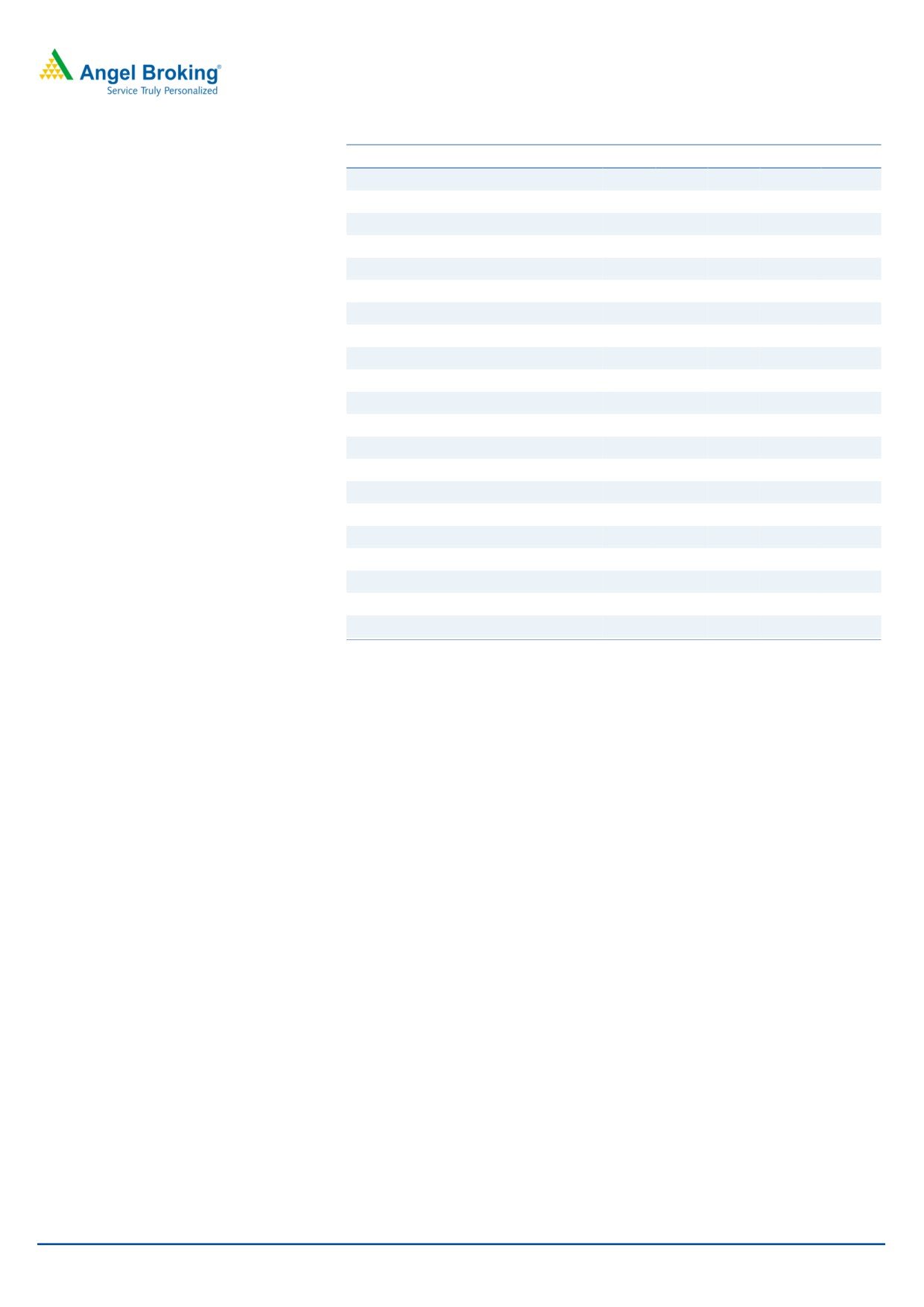

Income statement

Y/E March (` cr)

FY16

FY17

FY18

FY19E

FY20E

Total operating income

1,255

1,271

1,650

1,980

2,336

% chg

10

1

30

20

18

Total Expenditure

1,167

1,170

1,515

1,810

2,129

Raw Material

767

818

1,104

1,327

1,565

Personnel

141

160

189

208

245

Selling and Administration Expenses

76

86

107

128

151

Others Expenses

183

106

115

148

167

EBITDA

89

101

135

170

207

% chg

(65)

14

34

26

22

(% of Net Sales)

7.1%

7.9%

8.2%

8.6%

8.9%

Depreciation& Amortisation

38

41

48

58

69

EBIT

51

60

87

112

139

% chg

(76)

18

46

29

24

(% of Net Sales)

4

5

5

6

6

Interest & other Charges

13

11

8

8

8

Other Income

4

17

19

21

23

Extraordinary Items

-

-

-

Recurring PBT

41

65

98

124

154

% chg

(80)

58

51

28

23

Tax

4

10

26

32

40

PAT (reported)

37

54

71

92

114

% chg

(82)

48

31

29

23

(% of Net Sales)

2.9

4.3

4.3

4.6

4.9

Basic & Fully Diluted EPS (Rs)

39

58

76

98

122

% chg

122

48

31

29

23

Source: Company, Angel Research

August 28, 2018

7

LUMAX Industries | Initiating Coverage

Balance Sheet

SOURCES OF FUNDS

Equity Share Capital

9.4

9.4

9.4

9.4

9.4

Reserves& Surplus

259

300

353

416

494

Shareholders Funds

268

309

362

425

503

Total Loans

95

83

101

101

101

Other Liabilities

51

32

47

50

50

Total Liabilities

415

423

510

577

654

APPLICATION OF FUNDS

Net Block

425

419

532

657

685

Capital Work-in-Progress

-

20

34

34

34

Investments

69

79

88

105

117

Long Term Loans & Advances

31

2

4

3

3

Current Assets

332

348

562

599

707

Inventories

105

116

169

201

224

Sundry Debtors

181

191

318

380

416

Cash

3

1

2

15

57

Loans & Advances

36

-

1

1

1

Investments & Others

7

40

73

2

9

Current liabilities

444

456

721

837

917

Net Current Assets

-111

-109

-159

-238

-210

Other Non Current Asset

1

11

11

16

25

Total Assets

415

423

510

577

654

Source: Company, Angel Research

Cash flow

Y/E March (`cr)

FY16

FY17

FY18

FY19E

FY20E

Profit before tax

41

65

98

124

154

Depreciation

38

41

48

58

69

Change in Working Capital

(0)

(10)

(10)

58

79

Interest / Dividend (Net)

13

11

8

8

8

Direct taxes paid

4

10

26

32

40

Others

(7)

(7)

(14)

(131)

(240)

Cash Flow from Operations

89

111

157

149

110

(Inc.)/ Dec. in Fixed Assets

(38)

(63)

(132)

(161)

(64)

(Inc.)/ Dec. in Investments

1

1

4

(17)

(12)

Cash Flow from Investing

(37)

(62)

(128)

(178)

(76)

Issue of Equity

-

-

-

-

-

Inc./(Dec.) in loans

61

-13

19

-

-

Others

(120)

(27)

(30)

26

8

Cash Flow from Financing

(59)

(39)

(11)

26

8

Inc./(Dec.) in Cash

(7)

10

17

(4)

42

Opening Cash balances

18

3

1

19

15

Closing Cash balances

3

1

19

15

57

Source: Company, Angel Research

August 28, 2018

8

LUMAX Industries | Initiating Coverage

Key Ratio

Y/E March

FY2016 FY2017 FY2018 FY2019E FY2020E

P/E (on FDEPS)

52

35

27

21

17

P/CEPS

21

20

16

13

11

P/BV

7

6

5

5

4

EV/Sales

2

2

1

1

1

EV/EBITDA

23

20

15

12

9

EV / Total Assets

4

4

4

4

3

Per Share Data (Rs)

EPS (Basic)

39

58

76

98

122

EPS (fully diluted)

39

58

76

98

122

Cash EPS

96

102

128

161

195

DPS

0

0

0

0

0

Book Value

287

331

387

455

538

Returns (%)

ROCE

14

15

19

21

23

Angel ROIC (Pre-tax)

15

18

22

26

31

ROE

14

18

20

22

23

Turnover ratios (x)

Inventory / Sales (days)

30

33

37

37

35

Receivables (days)

53

55

70

70

65

Payables (days)

90

94

119

110

85

Working capital cycle (ex-cash) (days)

-7

-6

-11

-3

15

Source: Company, Angel Research

August 28, 2018

9

LUMAX Industries | Initiating Coverage

Research Team Tel: 022 - 39357800

DISCLAIMER:

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay Stock

Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd and National Commodity & Derivatives

Exchange Ltd It is also registered as a Depository Participant with CDSL and Portfolio Manager and Investment Adviser with SEBI. It also has

registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a registered entity with SEBI for Research Analyst in terms of

SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not been debarred/ suspended

by SEBI or any other regulatory authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any

compensation / managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision.

Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such

investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to

in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an

investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading

volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals.

Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources

believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for

general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or

damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not

independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or

warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavors to

update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us

from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Disclosure of Interest Statement

Company Name

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

August 28, 2018

10